This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

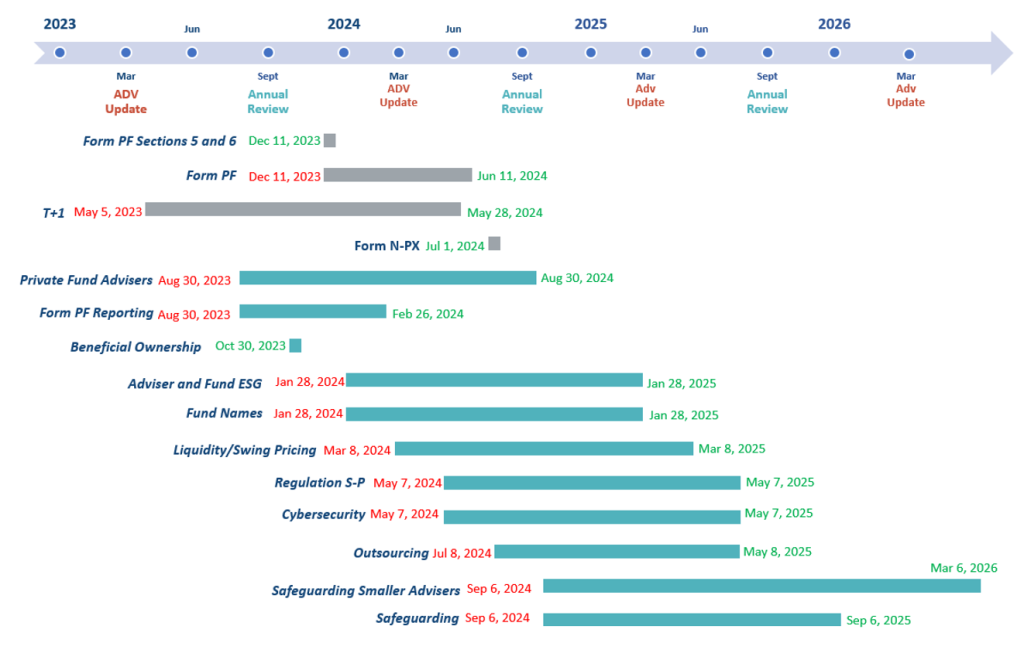

The graph is intended to clearly illustrate to the SEC that under the proposed compliance dates in these proposals, advisers would be required to implement these proposed rules during compressed and overlapping compliance periods while attempting to comply with existing ongoing regulatory obligations (e.g., implementation and annual reviews of compliance programs and annual updates to Form ADV). We also impress upon the SEC that advisers are already subject to an extensive array of other ongoing regulatory obligations intended to protect investors (e.g., compliance with the expansive requirements of the new Marketing Rule, recordkeeping, and other reporting and disclosure obligations, to name just a few).

The graph is intended to clearly illustrate to the SEC that under the proposed compliance dates in these proposals, advisers would be required to implement these proposed rules during compressed and overlapping compliance periods while attempting to comply with existing ongoing regulatory obligations (e.g., implementation and annual reviews of compliance programs and annual updates to Form ADV). We also impress upon the SEC that advisers are already subject to an extensive array of other ongoing regulatory obligations intended to protect investors (e.g., compliance with the expansive requirements of the new Marketing Rule, recordkeeping, and other reporting and disclosure obligations, to name just a few).