Press Release: IAA Calls for Holistic Review of Rule Proposals

June 20, 2023

Contact:

IAA VP of Communications & Marketing Janay Rickwalder.

IAA Calls for Holistic SEC Review of Adviser Proposals; Reasonable and Workable Implementation Timeline

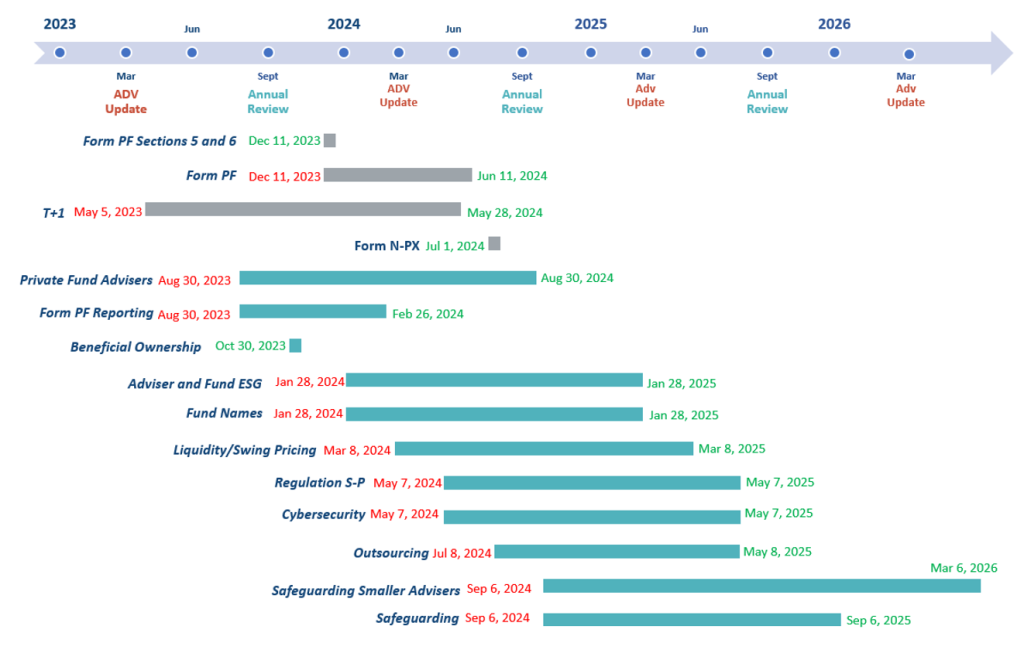

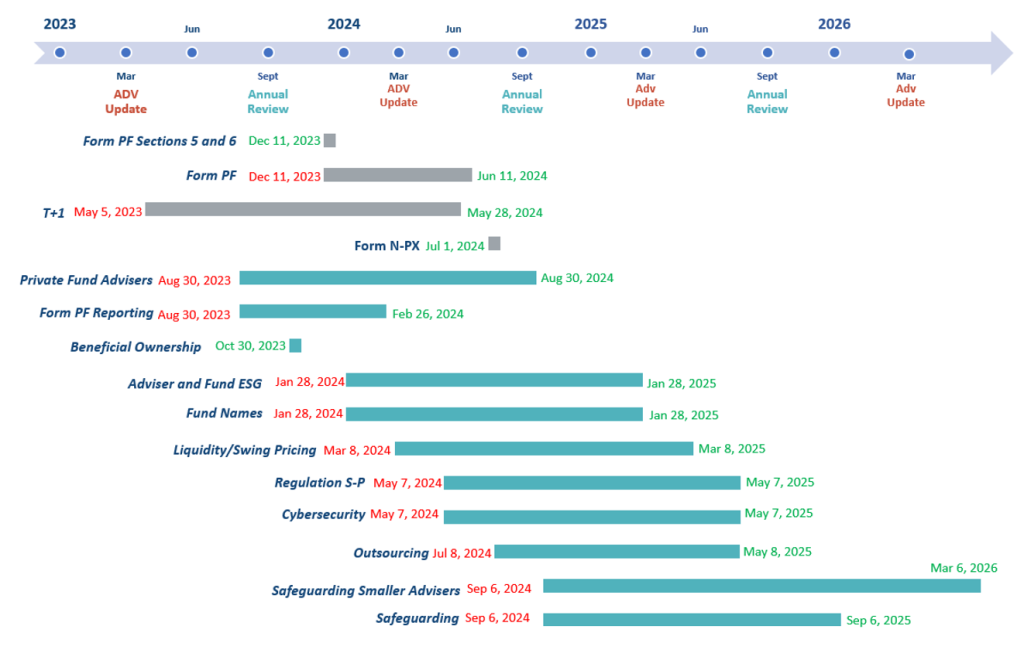

The Investment Adviser Association (IAA) has submitted a letter to the SEC requesting that the agency take a step back and holistically consider the practical ramifications of the more than a dozen consequential new rules and proposals impacting advisers that the agency has issued since SEC Chair Gary Gensler took office (listed in the graph below).

“Taken together, these regulations will significantly overhaul the current regulatory regime for advisers,” said IAA General Counsel Gail Bernstein. “If adopted, they also will disrupt existing infrastructures and relationships, with substantial implications for advisers, investors, service providers, and the markets,” she continued.

Specifically, the IAA letter urges the SEC to:

- Explicitly and cohesively address, prior to any adoption, the potential implications of the Outsourcing, Cybersecurity, Safeguarding and Regulation S-P proposals. The IAA letter explains how these four proposals are especially interconnected and include duplicative and potentially inconsistent requirements.

- Undertake a more expansive, accurate, and quantifiable assessment of the cumulative costs, burdens, and other effects that all of these proposed regulations, if adopted, would impose on advisers, their clients, and other market participants.

- Directly and accurately address how these regulations would affect smaller advisers and thoroughly consider and explicitly address alternatives.

- Before taking final action on these regulations, seek public feedback on a comprehensive implementation timeline for tiered and staggered compliance requirements and dates for all these proposals.

The IAA letter includes the following graph based on our reasonable assumptions regarding the effective and compliance dates being proposed by the SEC for each proposal.

###

About the Investment Adviser Association

The Investment Adviser Association (IAA) is the leading trade association representing the interests of fiduciary investment adviser firms. The IAA’s member firms collectively manage more than $35 trillion in assets for a wide variety of institutional and individual investors. In addition to serving as the voice of the advisory profession on Capitol Hill and before the SEC, DOL, CFTC and other U.S. and international regulators, the IAA provides extensive practical and educational services to its membership. For more information, visit investmentadviser.org or follow us on LinkedIn, Twitter and YouTube.